Health

Profit-taking continues as index sheds 266 points

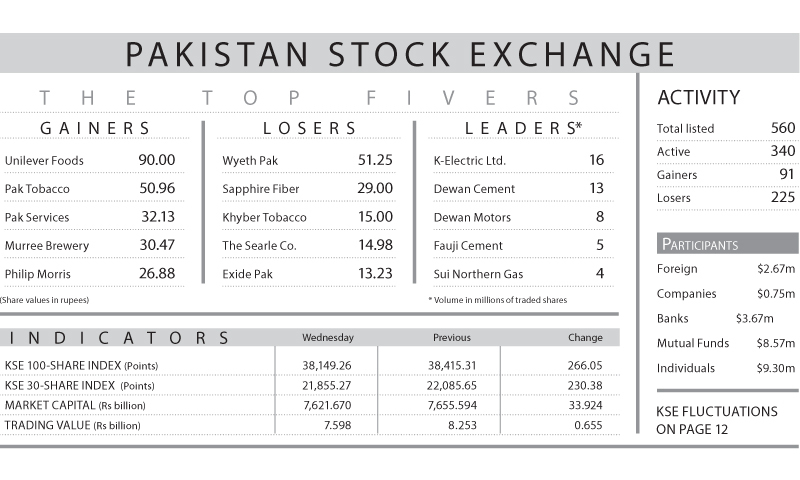

KARACHI: Stocks fell for the third day in a row, which market participants attributed to a ‘correction’ following 5pc gains the previous week. On Wednesday, the KSE-100 index plunged 266.05 points (0.7 per cent) and wrapped up the session at 38,149.26.

Trading yet again started off on a positive note with the index adding 205 points, before it succumbed to selling pressure in the late hours. Analysts reckoned that it was a result of investors squaring their positions in June future contracts, this being the future rollover week.

Volumes fell 20pc to 124.2 million shares while traded value declined 8pc to Rs7.6bn on Wednesday. K-Electric (KEL), Dewan Cement (DCL) and Dewan Farooque Motors (DFML) were volume leaders with combined traded volume of 36.4m shares. Foreign investors offloaded stocks worth $2.67m on Wednesday. Mutual Funds were major sellers though individuals absorbed much of the sell-off.

Analyst Arhum Ghous at JS Global pointed out that the stocks proposed to be part of MSCI Emerging Market Index continued their downward trajectory as HBL fell 0.95pc, MCB 2.25pc and LUCK 1.03pc. Pressure was seen in the E&P sector ahead of US weekly stockpile data due to be released on Wednesday. OGDC, down 1.01pc, was the major lag-gard of the aforementioned sector.

DCL fell 3.8pc and DFML 3.5pc as investors reacted to market news of the group’s failure to reach a restructuring deal. Interest was observed in Fauji Cement up 1pc and D.G. Khan Cement 0.5pc.

“Stocks fell sharply amid institutional profit-taking on weak earnings outlook,” said analyst Ahsan Mehanti at Arif Habib Corp.

Dismal data on $2.5bn current account deficit for July-May 2015-16, and concerns over foreign outflows played a

catalyst role in bearish close at the market.